Spring Housing Market Showing Strength

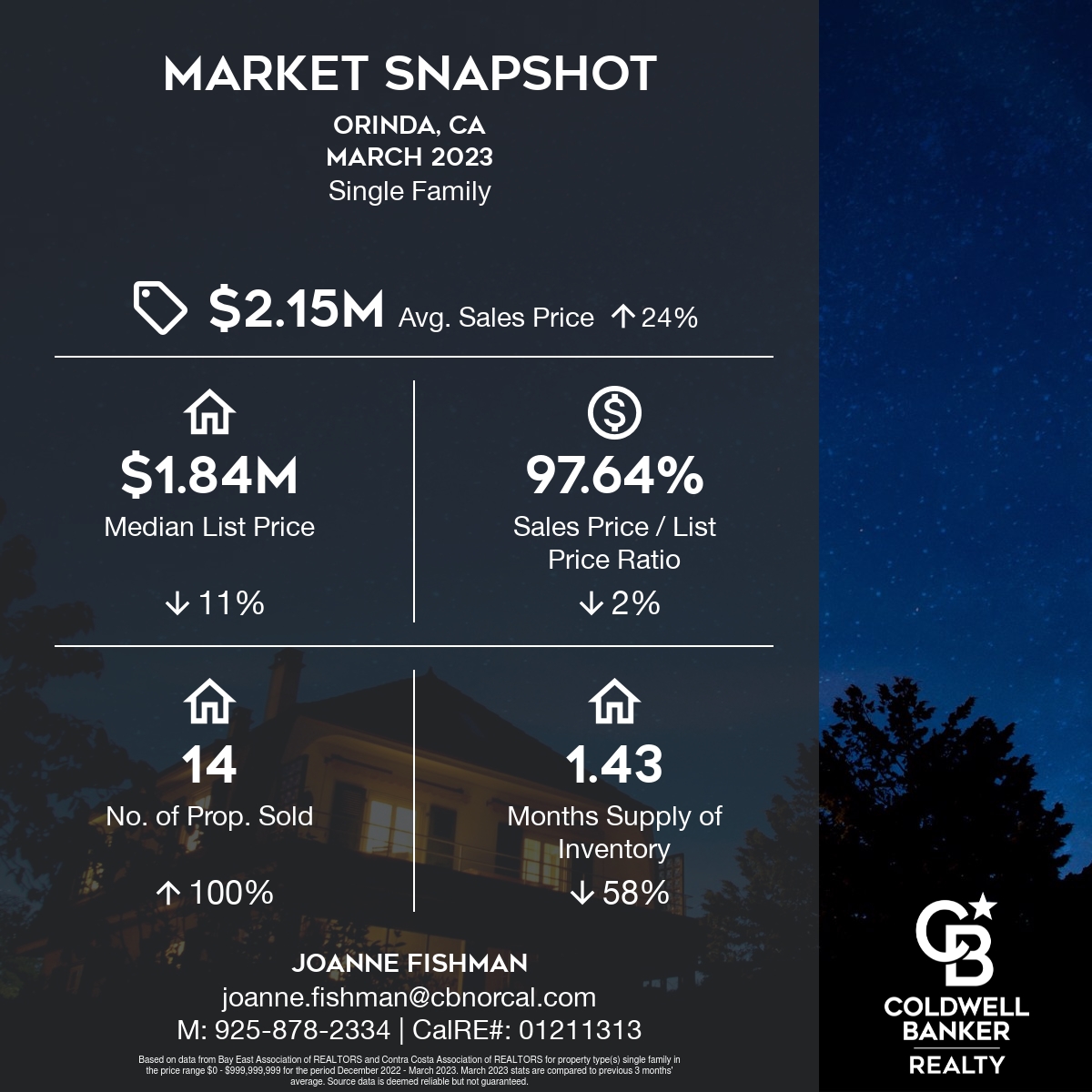

The spring housing market in the Lamorinda area is looking good largely due to the continued low inventory. Well-priced homes continue to see multiple offers. The market snapshot here shows the March 2023 sales figures for Lafayette compared to March 2022.

Home Sales Surge In The US

WASHINGTON (March 21, 2023) – Existing-home sales reversed a 12-month slide in February, registering the largest monthly percentage increase since July 2020, according to the National Association of REALTORS®. Month-over-month sales rose in all four major U.S. regions. All regions posted year-over-year declines.

Total existing-home sales,1 https://www.nar.realtor/existing-home-sales – completed transactions that include single-family homes, townhomes, condominiums and co-ops – vaulted 14.5% from January to a seasonally adjusted annual rate of 4.58 million in February. Year-over-year, sales fell 22.6% (down from 5.92 million in February 2022).

“Conscious of changing mortgage rates, home buyers are taking advantage of any rate declines,” said NAR Chief Economist Lawrence Yun. “Moreover, we’re seeing stronger sales gains in areas where home prices are decreasing and the local economies are adding jobs.”

Mortgage Rates Approach 7 Percent

The average rate on the 30-year fixed rate mortgage rose to 6.73 percent yesterday from 6.65 percent last week, according to mortgage buyer Freddie Mac. A year ago the rate was 3.85 percent. Despite fluctuations, mortgage rates have been trending upward, remaining nearly double what they were a year ago

“Mortgage rates continue their upward trajectory as the Federal Reserve signals an ore aggressive stance on monetary policy,” explained Sam Khater, Freddie Mac chief economist. ” The Federal Reserve’s interest rate hikes have driven up the cost of borrowing.

Khater went on to say, “Overall, consumers are spending in sectors that are not interest rate sensitive, such as travel and dining out. However, rate-sensitive sectors such as housing, continue to be adversely affected. As a result, would-be homebuyers continue to face the compounding challenges of affordability and low inventory.”

Mortgage Rates Heading UP

The average 30-year fixed rate mortgage rose to 6.65 percent yesterday from 6.50 percent the week before, reported mortgage buyer Freddie Mac. A year ago the average rate was 3.76 percent.

“As we started the year, the 30-year fixed rate mortgage decreased with expectations of lower economic growth, inflation, and a loosening monetary policy. However given sustained economic growth and continued inflation, mortgage rates boomeranged and we are inching up toward seven percent,” said Sam Khater, Freddie Mac’s chief economist.

Since peaking at 7.08 percent in November, mortgage rates remain nearly double what they were a year ago.

Is The Housing Market On The Rise?

A slight decline in mortgage rates in December and January contributed to an improvement in pending home sales for the second consecutive month. That’s according to data released this week from the National Association of Realtors. The pending index for January improved 8 percent.

“Buyers responded to better affordability from falling mortgage rates,” said NAR Chief Economist Lawrence Yun. NAR anticipates the economy will continue to add jobs throughout the year and in 2024, with the 30-year fixed rate mortgage steadily dropping to an average of 6.1 percent in 2023 and 5.4 percent in 2024.

“Home sales activity looks to be bottoming out in the first quarter of this year, before incremental improvements will occur,” said Yun. “But an annual gain in home sales will not occur until 2024. Meanwhile, home prices will be steady in most parts of the country.” Meanwhile, NAR also predicts median existing home prices will be stable for most markets–with the national median decreasing by 1.6 percent this year to $380,100 before regaining positive traction of 3.1 percent in 2024 to $491,800.

Is The Market Crashing?

The headlines can be alarming: “US Suffering From Second Biggest Home Price Correction of the Post-WWII Era”. When you hear the experts discuss real estate, keep in mind that all markets are local. And no. The market isn’t crashing. The market is coming down from a couple of years of fire-breathing acceleration, though. Some call this a return to normal. That’s what many are seeing here in East Bay.

The featured market snapshot of Lafayette shows that in December 2022 the average sold price of a single-family home was $2.12 million and this is three percent down from the prior December. Last spring home prices here were rising some 23 percent year over year, a figure that is not sustainable despite the relatively low inventory. As the 2023 home-selling season starts to get underway in the next few weeks, we are still likely to see a well-prepared and a well-priced home getting a few offers rather quickly.

U.S. Home Sales Continue To Decline

Existing-home sales in the U.S. declined for the 10th straight month in November, the National Association of Realtors reported today. This record stretch of declines reflects the high mortgage rates and home prices that have caused many buyers to leave the market.

“Today’s sales activity in November is essentially almost the same as that lockdown period back in May 2020,” said Lawrence Yin, NAR’s chief economist, and “… are clearly reflecting the rapid rise in mortgage rates.”

Sales of previously owned homes dropped 7.7 percent in November from October to a seasonally rate of 4.09 million. This rate also is down some 37 percent since January. The housing market slowdown also illustrates the effect of the Federal Reserve’s aggressive interest-rate increases in an effort to fight high inflation by slowing spending.

While home prices have declined from their springtime peaks, nationally prices are still up from last year, largely due to the lack of supply. The median existing hone price rose 3.5 percent in November from the prior year to $370,000, reports NAR. The record, reached in June, was $413,800.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link