The housing market in California continues to cool down, according to the California Association of Realtors’ report today. Existing family home sales in June declined 8.4 percent from May and nearly 21 percent from a year ago. In addition the median home price statewide was 863,790 which is down 4 percent from May but up 5.4 percent from last June.

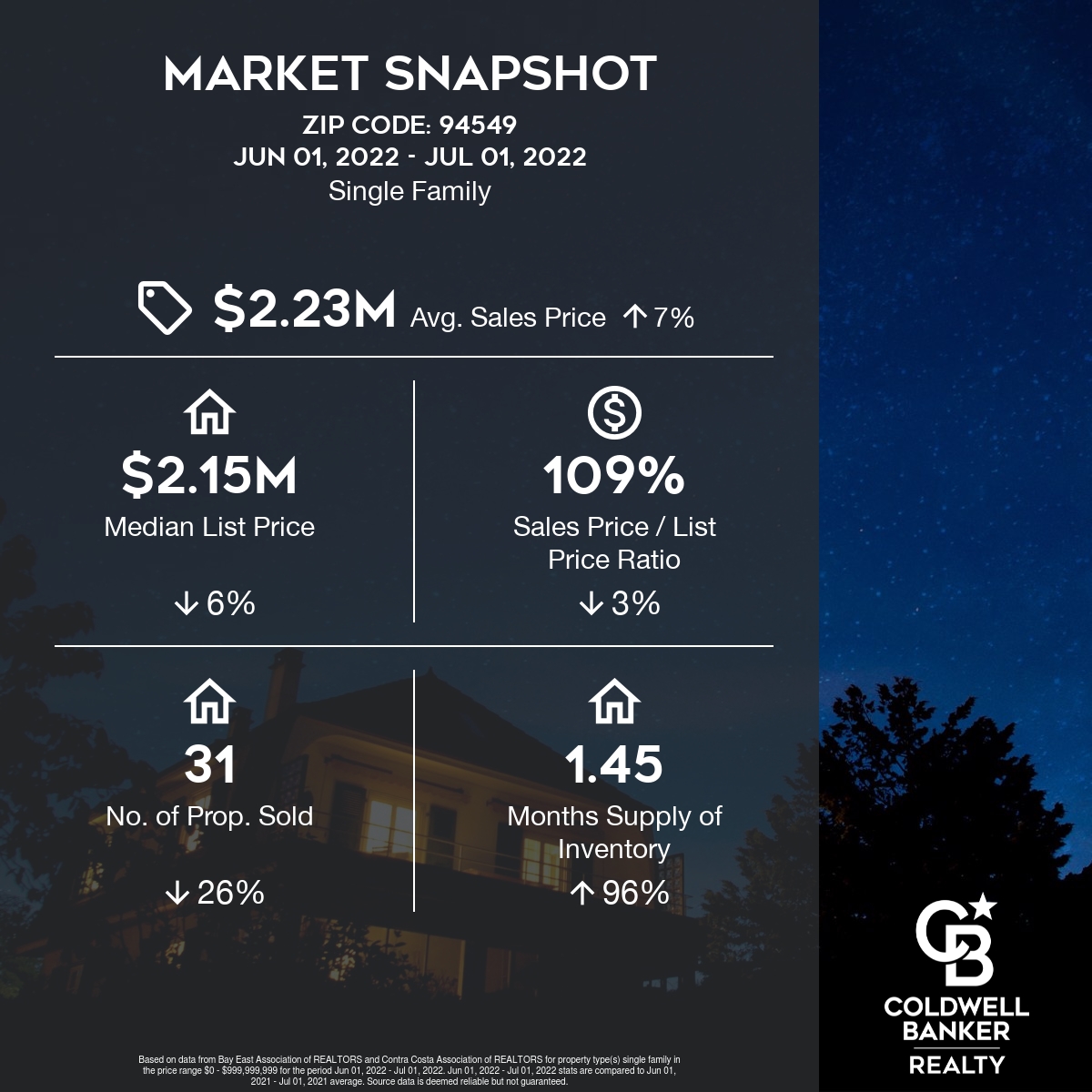

in Contra Costa County home sales dropped 18 percent in June from May and 31 percent from a year ago. The average sold price lsat month stood at $976,940 which is 14 percent lower than May and 1.3 percent lower than June 2021.

“Excluding the three-month pandemic lockdown period in 2020, June’s sales level was the lowest since April 2008, explained CAR Chief Economist Jordan Levine. “Pending sales data also suggests we can expect additional retreating in the coming months. With inflation remaining high and interest rates expected to climb further in the coming months, the market will normalize further in the second half of the year with softer sales and more moderate price growth.”

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link